For most people, Super is difficult to engage with. It’s too far away. It addresses something you don’t want to think about – ageing. It’s a problem for your parents.

So how do Super Funds generate real interest in a majority of their customers? How can they build the engagement? What’s been holding back the Funds for all these years?

Like any component of the Australian financial sector, it is highly regulated and controlled. Super Funds are faced with constant demands to meet new compliance and regulatory requirements. It can be hard for these Funds to demonstrate innovative ideas when much of their budget, resources and people and tied up in compliance related activities.

For the Funds to truely be allowed to build that customer engagement, they need to be free to innovate. They need their resources and budgets to be freed up to enable real business change and to be able to test out now business and product ideas.

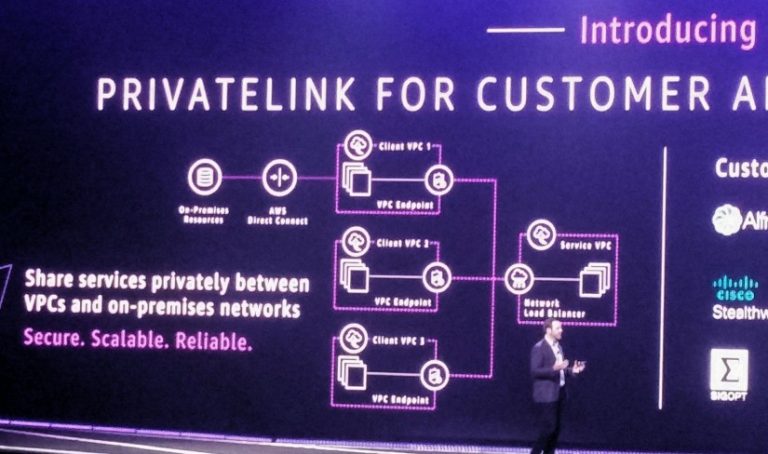

In 2016, there is a way for Funds to jumpstart their businesses through technology – the Cloud. Outsourcing infrastructure to the Cloud and adopting a consumption based approach to technical solutions enables businesses to experiment far quicker and at a far lower cost then ever before.

With Super Funds in particular, the challenge is to provide solutions to their diverse customer bases that are responsive and relevant. The magic bullet for the Funds is for a customer to select them as the Fund for life no matter where their career takes them. By using the power of the Cloud to innovate, to analyse data and understand their customers, the Funds can start to unlock the engagement puzzle and offer a personalised experience to each of their customers.

Super should and could become as central to an individuals personal finances as their mortgage. All it takes is the power of the Cloud.